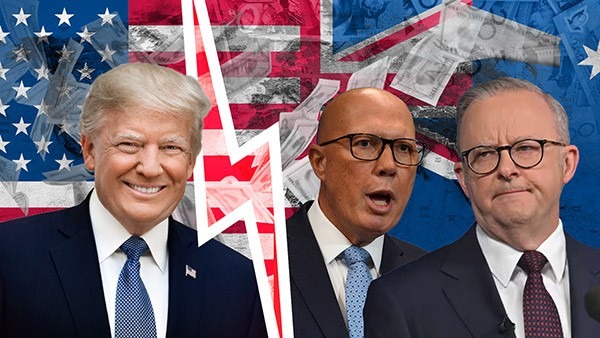

Special Edition: Australian Election & Trump Tariffs

On Tuesday 25th March 2025, Treasurer Jim Chalmers delivered the 2025-26 Australian Federal Budget early due to the prospect of an early decision to call the election. Soon after Prime Minister Albanese called the Federal Election for the 3rd May 2025 and led Labor to a resounding second term victory.

Whilst the Budget delivered some expected voter pleasing policies, such as personal income tax cuts, increased Medicare bulk billing, and cost of living relief, it has generally been viewed as underwhelming, despite record revenues.

In recent times, the mayhem of the Trump Tariffs, stirring global economic uncertainty and stock market volatility around the world has added an interesting layer that impacts everyone and will have a bearing on how the newly elected Government will deal with the Trump Administration. What is apparent, is a shift in USA International policy of “doing the right thing” being replaced with “doing it for the right price”.

Are the tariffs going to achieve the goals of the Trump administration or are we headed for years of chaos? Were the tariffs really necessary and are there legal grounds to impose them? And will the goals of the tariffs match reality?

As a special 30th year celebration of the SMATS Group of companies, we invite you to watch our 21st Annual Australian Budget Review, presented by Steve Douglas, to gain insight into:

- Key insights into the Federal Budget announcement

- Analysis of the economic responses and new initiatives

- Review the revenue and expenditure priorities

- Evaluate how the budget may shape the economy and property markets

- The budget impact on Australians, expats, intended migrants and investors

- Review of the ongoing impact of Trump’s Tariffs.

ABOUT THE SPEAKER

Steve Douglas is the Co-Founder and Managing Director of Australasian Taxation Services (ATS) and Chairman of SMATS Group. He is a Chartered Tax Advisor, Fellow of the Taxation Institute of Australia and a Registered Tax Agent.

This is the 21st year in succession that Steve has presented this seminar, which provides a unique perspective of the current and historical aspects of the Budget and its influence on individuals and markets.

Steve is the author of ‘The Aussie Expat – The Luckiest Person on Earth’, the only concise reference book for expatriate tax planning and financial management which has sold more than 10,000 copies.

In 2005 he founded aussieproperty.com, the leading independent source of information and services for investors of Australia property, with over 10,000 members.

Steve Douglas was awarded the Singapore Finder Expatpreneur Award in 2017, the Qantas Entrepreneur Award 2010 by AustCham Singapore and was identified as one of the leading 50 Australians in Asia and invited to attend the Asia 50 Summit by Advance 2009