Andrew Jackomos and Rohit Sharma of HLB Thailand assess how country-by-country reporting (CbCR) regulations are evolving in Thailand, and consider the implications for businesses.

The Thai Revenue Department (TRD) has recently released draft rules for the country-by-country report (CbCR or CbC report) for public consultation. These rules propose making the CbC report effective in Thailand for accounting periods commencing on, or after January 1 2020, so taxpayers need to familiarise themselves with the proposal.

The changes have come about as part of Thailand’s commitment to implement the OECD/G20 BEPS project outcomes. This is a significant development for Thailand, which informs the world that it serious about tackling BEPS.

The draft rules spell out the definitions as provided by the 2017 OECD Transfer Pricing Guidelines for enterprise groups, multinational enterprise (MNE) groups, constituent entities (CE), ultimate parent entities (UPE), and surrogate parent entities (SPE).

Taxpayers are provided guidance on matters, such as who will be impacted by this law, what are the filing obligations, the format of CbCR, means of filing the CbC report and the timelines.

Which entities are subject to CbCR?

Any entity that satisfies one of the following criteria, and has consolidated group revenues of no less than THB 28 billion ($925.6 million approximately) in the immediately preceding accounting period, is obligated to prepare and submit a CbCR.

If the accounting period of the preceding year is less than 12 months, the revenue threshold will be calculated proportionally to such accounting year. For example, if the accounting period of the immediately preceding year was from January 1 2020 – June 30 2020, the revenue threshold would be THB 13,923.50 million (THB 28 billion x 182/366 days).

General cases

- A Thai headquartered (HQ) MNE group – an entity registered under Thai law and is the UPE of the group, or the SPE as appointed by the UPE to file the CbC report in its tax jurisdiction, as required.

- The SPE registered under Thai law – as appointed by the group to file the CbCR on behalf of the group.

Specific case

- A foreign UPE of the MNE group (located outside of Thailand) that does not require the UPE to file a CbC report in its tax jurisdiction and the UPE does not appoint the SPE in the jurisdiction that requires surrogate parent filing of the CbC report;

- If the foreign UPE of the MNE group or SPE, located outside of Thailand, does not have a qualified competent authority agreement (QCAA) with Thailand, or such QCAA is not yet effective at the last day of the CbC report submission period; or

- The TRD has been notified of the systematic failure from the residence jurisdiction of the UPE or SPE.

Reporting format

The CbC report should be in English and filed electronically. It should follow the CbC report XML Schema as prescribed by the OECD. The currency used when preparing the CbC report would be the functional currency of the UPE.

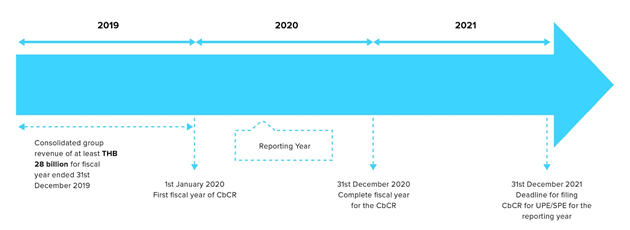

Below is an illustrative chart that assumes the reporting entity has a December 31 year-end, summarising the CbC report timelines:

Figure 1: CbC report timelines

Assessing the impact of the draft rules

It can be argued that the most significant impact will be felt by Thai HQ MNE groups which will be required to prepare and file a CbC report for the first time as a result of the new rules. The draft rules are mostly in-line with the OECD.

For the MNE groups with UPEs located outside of Thailand, operating within Thailand, the new rules provide flexibility and allow for CbC reports (FY2020 and onwards) to be filed in Thailand.

Although Thailand has signed the multilateral competent authority agreement (MCAA), it is yet to activate any exchange relationships with other tax jurisdictions. Nevertheless, it is expected that these will be activated to enable the exchange of data/information with other tax jurisdictions automatically.

There are still many unanswered questions, such as whether a local filing is required for previous years (in case the Thai group was subject to CbCR in other countries), notification requirements, or how to address different year ends to arrive at a consolidated group revenue.

It is expected that the TRD would release formal guidance on areas discussed above to implement the rules effectively.

It is an opportune time for MNEs to evaluate their transfer pricing risks and ensure that their policies properly allocate profits to the various jurisdictions in which they operate.