The value of US 20 year treasuries has fallen by over 11% this year …Should we all be buying treasury bonds?

Inflation tends to lead to interest rates moving higher and invariably the prices of US treasury bonds move inversely to yields (i.e. when rates increase, or are expected to increase, bond prices fall).This expectation of inflation is currently one of the most widely held beliefs across capital markets (there are currently more bets on the price of bonds falling than there have been for some time). However, we’re not so sure that this is right – or rather I’m not sure that there exists yet any proof that this is the case.

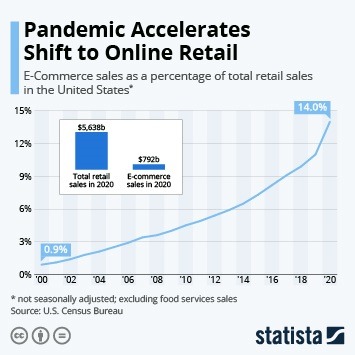

Pent up demand but not for the high spend luxury market – We don’t believe the argument that higher savings will result in sustained higher consumption patterns. Luxury brands haven’t been impacted much by the Covid-19 outbreak as the high income bracket has continued to spend while for non-luxury items growth depends upon habits adopted during Covid-19 such as online ordering to return back to the old way of high street shopping and eating out.

The pent up demand expectation seems to be based on the belief that once COVID has gone away (through vaccinations/herd immunity) this will unleash a wave of ‘pent-up’ consumer (and business) spending causing a strong rebound in economic growth that will lead to dramatic reductions in unemployment and result in more Americans having higher levels of disposable income that in turn will create higher consumption, and eventually a tighter labour market with higher wages and higher levels of economic activity that ultimately result in inflation because of these higher wages and this higher demand for goods & services (although this cycle didn’t happen pre-covid despite record employment numbers).

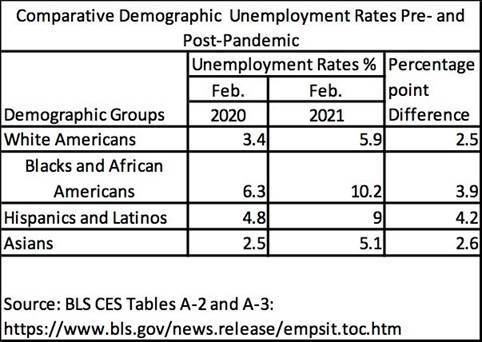

Superficially that sounds plausible but we have several issues with this, partly because it’s an oversimplified explanation of how inflation works but also the latest official US unemployment data indicates that the ethnic groups that have been hit hardest are those with the lowest average income levels (Black/African Americans, followed by Hispanic/Latinos). The lowest wage earners would in our view logically account for the majority of the dip in consumer spending in the US seen since the outbreak in Covid-19 (not the wealthy who continued to spend pretty much as usual as far as we can tell). The lower income groups tend to spend all of their surplus income, and as this group also has made up most of the increase in unemployment numbers we suspect that a broad based consumer recovery at this time is unlikely. The lowest income levels have seen a depletion of savings/increase in debt levels.

Many of the ‘missing jobs’ are in retail, transportation, construction and leisure/hospitality – Luxury goods sales have held up well.

We suspect that those in the highest wealth and income categories (where savings have generally increased significantly) might have less pent-up demand – going back to the point of interest that sales of the highest profile luxury brands have generally held up well.

Too many people with limited spending power – no surge in luxury, a volume surge, a retail margin squeeze in middle ground and too many consumers with limited spending power and this doesn’t seem likely to lead to a hiring rush. We’d apply a similar expectation to leisure and to travel and also to new home sales.

Change of habits – we note that consumers have changed their habits during the lockdown – whether buying goods online, exercising from home, working from home or ordering at home dining. We find it hard to square this change in consumption habits with expectations of the great re-opening leading to a huge re-hiring. Can we really expect there to be something like the 2.5 million jobs created to take these 4 sectors back to where they were pre-COVID? That seems a huge contradiction to us. As well as the 2.5 million in these 4 sectors who became officially unemployed in the last 12 months, many of the other 1.5 million official non-farm employees who lost their jobs during this time and have been unable to find employment are also dependent on these four sectors. If we don’t go back to the same lifestyle habits as before, then these four million of these jobs are unlikely to return.

What’s more, as of last month, there were a further 6.9 million Americans classified as ‘not in the labor force’ but seeking employment. This may include some of the 3-4 million new workers who would have joined the workforce in 2020-21 but haven’t been able to, but there is an employment crisis with up to 20 million Americans out of work.

If the majority of these can find gainful employment and add to consumption, this would have a huge impact. But there are currently no signs that this is happening.

It doesn’t just seem to be an issue of confidence – if we look at the pre-COVID official unemployment, we can see that the worst performing employment sectors were leisure/hospitality, construction, professional services, non-durable goods and retail. The weakness in the US economy didn’t begin with COVID and therefore it seems to be a leap of faith to suggest that herd immunity and mass vaccinisation will cure that weakness.

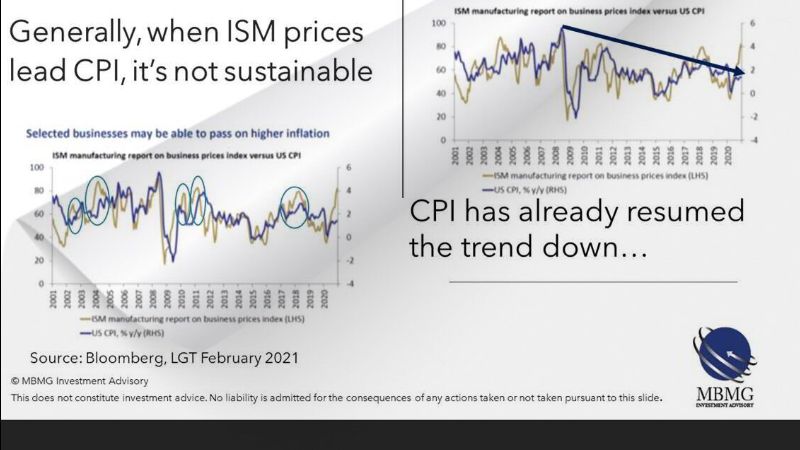

We have repeatedly said that we think that there will be volatility in most data in the coming months, including inflation data but maybe the clearest signal that we’re not yet seeing recovery is that the only inflation that is rearing its head is at producer inflation at factory gates. This strikes us as supply driven and historically tends to be transient unless accompanied by higher prices on the High Street (Consumer Price Inflation or CPI), which tends to better reflect surging demand. Right now, this isn’t happening.

Should our suspicions be right and inflation data doesn’t take-off then US long-term treasury bonds would appear to offer attractive value.

Notes

For a better explanation of what really causes inflation see- An MMT response on what causes inflation | Financial Times (ft.com)

The latest US employment data reveal the following

For anyone still clinging to any notions of ‘trickle down economics’, this is a good satirical, Australian rejoinder (https://twitter.com/i/status/1340881792266428417).