By Paul Gambles

Markets to Define the “War”🔥🔥

In my view, tensions are likely to remain elevated, probably for a considerable time but, barring any major accidents, or a repeat of 1913, when the world ‘sleepwalked into war’, the threat is now more clearly defined and in full sight.

Making predictions, especially about the future, is always perilous and now more than usual, but our base case is that barring any global escalations, markets will eventually become inured to the situation and asset prices will shrug off the reclaiming of Kiev (if things even getผฟ that far). Therefore, we hope and expect that in six months’ time, there will have been no escalated response by NATO and that markets will have learned to live with the situation, in which case the calculus becomes about the sequencing of:

- Ukraine tensions subsiding or just growing stale (RELIEF FOR MARKETS)

- Supply chain shocks, price spikes and spooking policymakers (BAD FOR MARKETS)

- The Fed striking an accommodating tone in response to downside growth risks (GOOD FOR MARKETS)

- The slowdown starting to bite (BAD FOR MARKETS)

This sequence has been increasingly compressed as economic conditions have deteriorated more quickly than might have been expected. I don’t have the capability to anticipate how that sequencing might play out BUT we will of course be monitoring closely.

The good news is that since we published https://mbmg.substack.com/p/existential-risk-why-we-all-need just over a month ago, events have played out in a way that suits the portfolio positioning advocated by MBMG Investment Advisory.

To a Man with a Hammer, Everything Looks Like a Nail…

To central bankers, who have never seen such a dramatic supply shock in their careers,

all inflation is assumed to be excess demand.

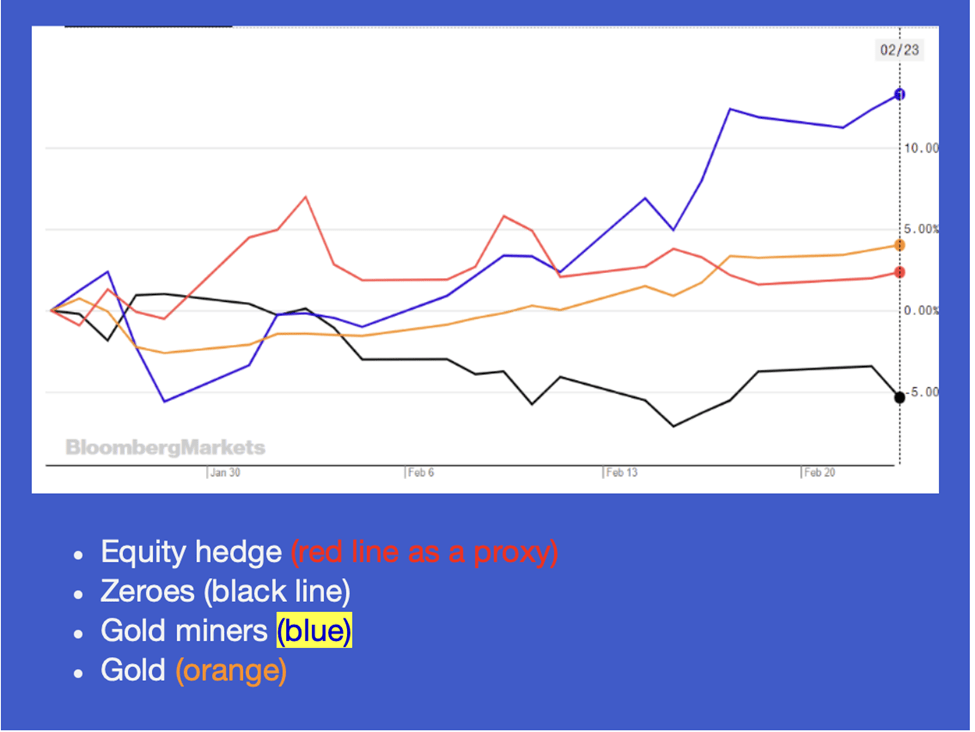

The Chart below displays equity versus Risk-Hedge Assets

The run-up in this combination of holdings has created opportunities to take profits and gives rise to the possibility of price spikes that will create even greater opportunities.

We still think that the longer-term opportunity remains in place for risk hedge assets that we’ve chartered above but if gold or gold miners achieve or exceed our 2023-4 price targets in the coming days and weeks, we should be alert to the profit-taking potential and any short-term spikes also give rise to the likelihood of a pullback buying opportunity in the interim.

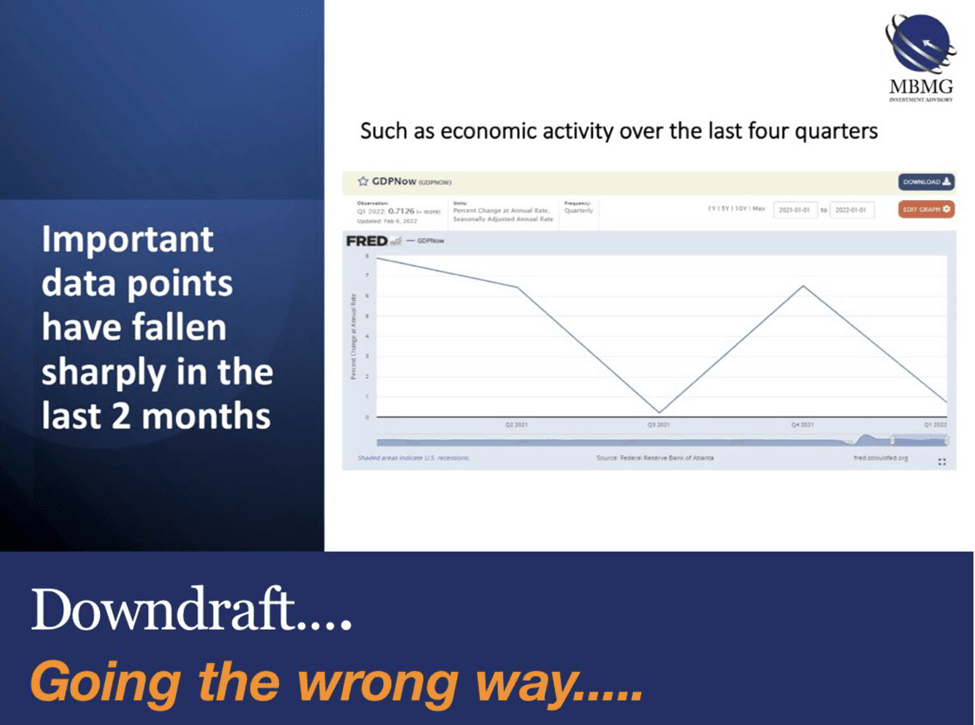

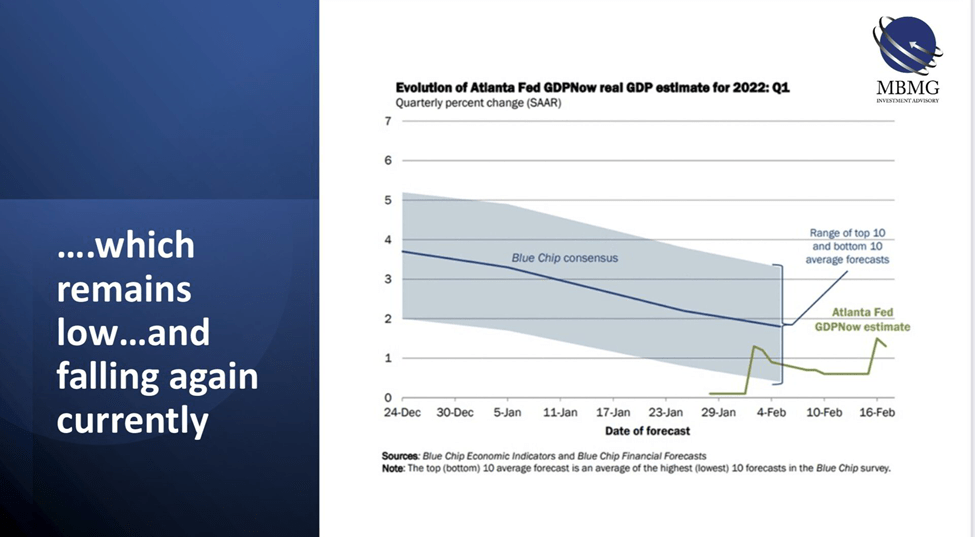

Perhaps the only voice louder than the market panic has been the chorus of investment funds citing statistics such as the precedent that US equity markets typically turn positive in the 1 and 3 months after this kind of dislocation. However, it’s important to remember that market weakness preceded the Ukraine issue and that market conditions are fragile, for structural economic reasons:

It seems to me that the perfect backing track for the terrible international relations mistakes being made

by the current US administration is Murray Head’s haunting anti-war song, “Say it ain’t so, Joe” –

Conditions remain particularly challenging and policy decisions are exacerbating this. It may be a slight,

but only slight exaggeration to say that the Fed never met a US recession that they didn’t start!

Download Full Report – Downdraft Going the wrong way from MBMG

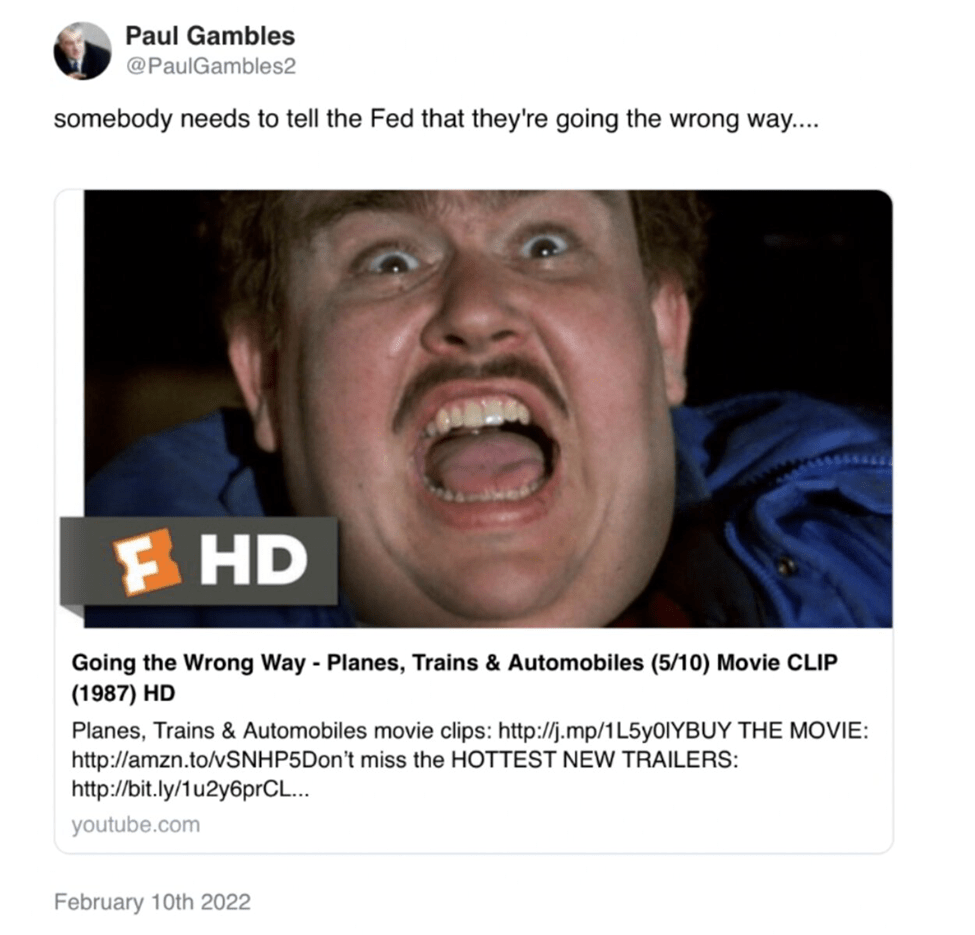

Whereas America’s economic and financial policymakers remind me of John Candy in ‘Planes, Trains & Automobiles’

Thanks for reading MBMG Flash!! Subscribe for free to receive new posts and support our work.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at [email protected] or call on +66 2 665 2534.