Capital always does what capital does. It flows to the places that make the highest returns and the highest returns over the last year were some pretty crazy places. As we know it was Tesla, Ark funds, cryptos and SPACs (so-called ‘blank cheque’ special purpose vehicles where well-known managers raise funds from investors, and then find venture capital and private equity opportunities to invest into and to list on markets in reverse listings and public offerings).. That’s just where the best market returns have been. That’s a fact of how liquidity fuels bubbles but it doesn’t last forever and the liquidity that’s driven these bubbles is not coming in at the same rate anymore so we could see these bubbles heading into a pretty nasty storm. Remember, liquidity-fuelled, bubbles need continued increasing inflows and we’re not getting that anymore.

In short, liquidity has fuelled risk assets, especially meretricious[1] ones, but value is difficult to discover in risk assets, except where it reflects discounts in other asset classes such as gold bullion, that hasn’t attracted bubble capital.

Liquidity has largely Ignored Higher Quality, less Volatile assets.

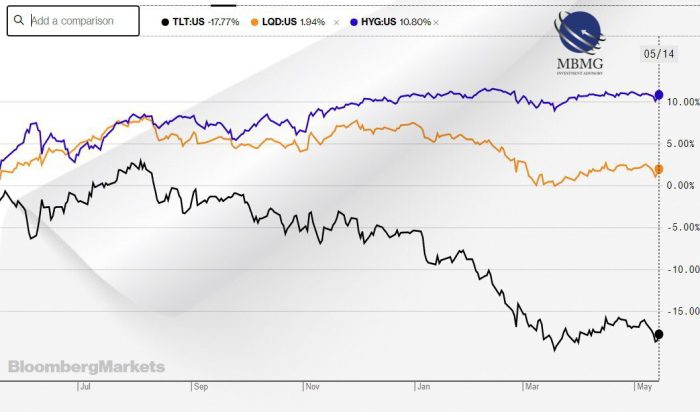

Another example of an underperforming asset class is US treasuries. In a mirror image of the equity market, high risk, illiquid corporate bonds have dramatically outperformed both less risky and less illiquid high quality corporate bonds and highest quality, most liquid treasuries:

This during a period when deteriorating economic conditions led to record number of credit downgrades (which should have adversely affected high yield above all).

Just to recap- liquidity, logically, found its way to the places where it had the greatest impact but, if anything, this led to outflows from the places where it would have the least impact, such as gold and treasuries (physical gold and gold miners have rebounded in recent weeks but mainly for the wrong reason which seems to be ‘mispriced’ inflation expectations).

Exaggerated & Misplaced Inflation Expectations Higher inflation expectations over a short-term are justified as of course many commodities are higher than they were a year ago when the price of oil, for instance, traded at a negative number as well supply chain disruptions and post-Covid lockdown bottlenecks. Several other commodities including lumber, rubber, and steel have also spiralled over the past 12months (along with e. g. freight and transport costs for equivalent reasons) but that doesn’t equal inflation because these prices are supply shocks and are not ‘sticky’ and the mechanisms of these markets will work them out before too long, and in fact this seems to have started already. Sticky factors, like wages, still seems suppressed in real terms.

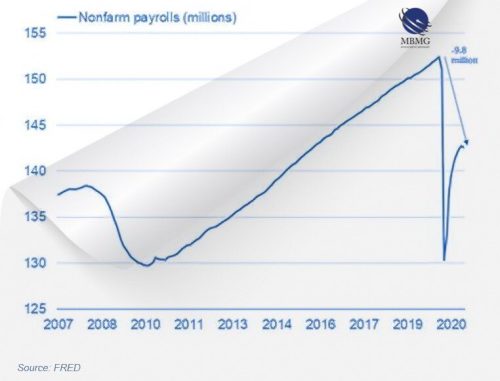

Stimulus hasn’t adequately addressed needs of the Job Market The number of US employees remains almost 10 million below pre-COVID levels and the best part of 14 million people less than it would have otherwise been projected to be at this stage:

Debt, Demographics and Dispersion reduce the effectiveness of US Stimulus of US employment (and real personal income) which was stagnating before the COVID outbreak. Growth has been in a secular decline for multiple years, private debt levels remain at post-GFC highs and long-term growth expectation indicators remain bleak. On top of these structural issues, debt level and dispersion worsened during the COVID lockdown and COVID ‘scarring’ effects are an added psychological burden on re-opening. The economic outlook was challenging before COVID. The failure of stimulus to address or adequately mitigate these challenges has only made this outlook even darker. Unless there is a radical change in the nature of stimulus policies, there is no reason to expect that additional stimulus measures will have any impact other than fuelling further liquidity bubbles in other risk assets, while doing nothing nearly enough to address the economic challenges.

Further Stimulus will likely create new Bubbles The real economy is an even less attractive proposition for generating immediate returns on capital and therefore, along with low risk, liquid assets, appears to have also failed to benefit. Capex and hiring remain extremely subdued (we’ve covered this in pieces such as The value of US 20 year treasuries has fallen by over 11% this year …Should we all be buying treasury bonds? and Stimulus – Will it Work?

MBMG NOTE

In short, Mind the Gap (between the bubble valuations & the real economy), be aware of pricing distortions driven by the huge liquidity inflows experienced over the last year and the scale of further inflows needed to sustain these bubbles, especially as the real economy continues to deteriorate, increasing the gap between the price of meretricious assets and hamstrung economic fundamentals.

We have every reason to think that these insights will stand us in good stead by St Leger’s Day although picking the winner seems as daunting as ever.