Bangkok, Thailand – February 29, 2024 – CBRE Thailand shares, Thailand begins 2024 with a cautious outlook, both economically and for the real estate sector in general. CBRE Thailand, the leading international property consultant, highlights key trends to watch in the residential, office, retail, industrial and logistics, and hotel sectors in Thailand.

Ms. Roongrat Veeraparkkaroon, Managing Director of CBRE Thailand, stated, “2024 started with a cautious outlook for the first half, with the prospect of a more active market in the second half of the year. Higher interest rates and concerns over inflation saw end-of-2023 GDP numbers fall well short of expectations. As a result, we expect the early part of 2024 to be relatively muted in terms of activity. However, it should be noted that several very large-scale mixed-use real estate development projects are ongoing, and two will come to fruition this year as Bangkok’s real estate industry continues to evolve. These projects will set new standards of design and development excellence for living, working and entertainment spaces in Thailand.”

“GDP for 2023 reached 1.9%, falling short of the targeted 2.4%. Although the GDP target for the current year has been forecasted at 3.2%, there is a possibility of a downward revision in the near future. While prospects for an increased number of tourists look promising and momentum builds for additional FDI, the domestic economy has weakened in line with many global economies, reflective of the uncertainties caused by more conflicts and a year of pivotal elections throughout the world. Of additional importance is how the Thai government balances its instinct to provide a fiscal stimulus without impacting rising concerns over government debt,” added Ms. Chotika Tungsirisurp, Head of Research and Consulting at CBRE Thailand.

Residential

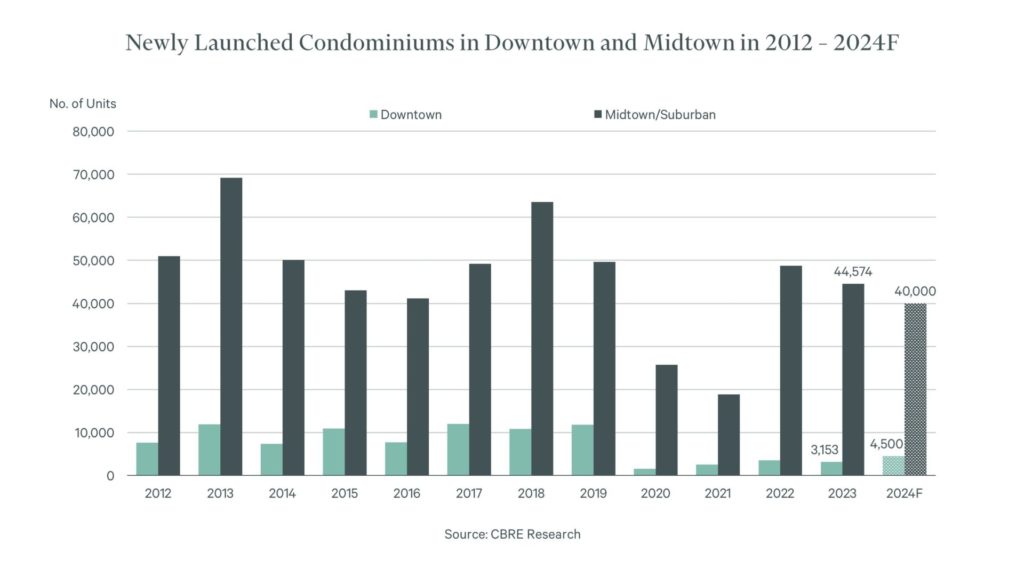

Rising interest rates and weak GDP are generally negative factors for the residential sector. While many developers announced plans in 2023 to surpass the number of launches for both housing projects and condominiums, as the year progressed, developers took time to assess the potential impact of negative economic factors, both domestically and globally, on the demand for residential property. In retrospect, the numbers indicate more subdued activity, with fewer launches for both condominiums and housing compared to 2022.

Newly Launched Condominiums in Downtown and Midtown in 2012 – 2024F

Source: CBRE Research

The residential market in Bangkok is mature and extremely competitive, and successful developers need to act dynamically to adjust to market trends. The early signs for 2024 suggest that there will be more activity in the downtown condominium market, particularly in the luxury and super-luxury segments. Projects will comprise a lower number of units, many under 100, with a focus on large units to target domestic end-user demand and second homes for foreign buyers. While we expect the number of downtown condominium launches to be higher than in 2023, many developers will not officially launch their projects until they have gained sufficient confidence from their targeted pre-launch marketing campaigns.

While the housing market was particularly active over the last two years due to pent-up and new demand, we anticipate fewer low-rise housing launches overall in 2024 as developers remain mindful of increased supply and stricter bank lending policies for both project loans and mortgages. There is likely to be more focus on the high-end housing market (THB 15–30 million), where there is still real demand.

Ms. Artitaya Kasemlawan, Head of Residential Sales – Project BKK, commented, “We also expect that there will be fewer project launches in the first half of the year, in the hope that the Bank of Thailand will reduce lending rates. This will lead to more positive sentiment and lower mortgage rates, with an increase in project launches in the second half of 2024.”

For the resale condominium market, we expect continued interest in large secondhand units, which offer buyers the opportunity to renovate to a high standard at a lower overall cost than newly built units. New, fully furnished, ready-to-move-in units are also popular, as buyers can visualize the completed product and do not need to undertake any work before moving in. Overseas demand for Thai buyers is focused on the U.K. for educational purposes or lifestyle destinations such as the Maldives or Japan,” added Praphinleeya Phuengkhuankhan, Head of Residential Sales – Ad Hoc.

Key trends:

• Increase in downtown Bangkok condominium product variety

• More residential projects within mixed-use developments

• Housing launches to focus on upper mid-level market

Office

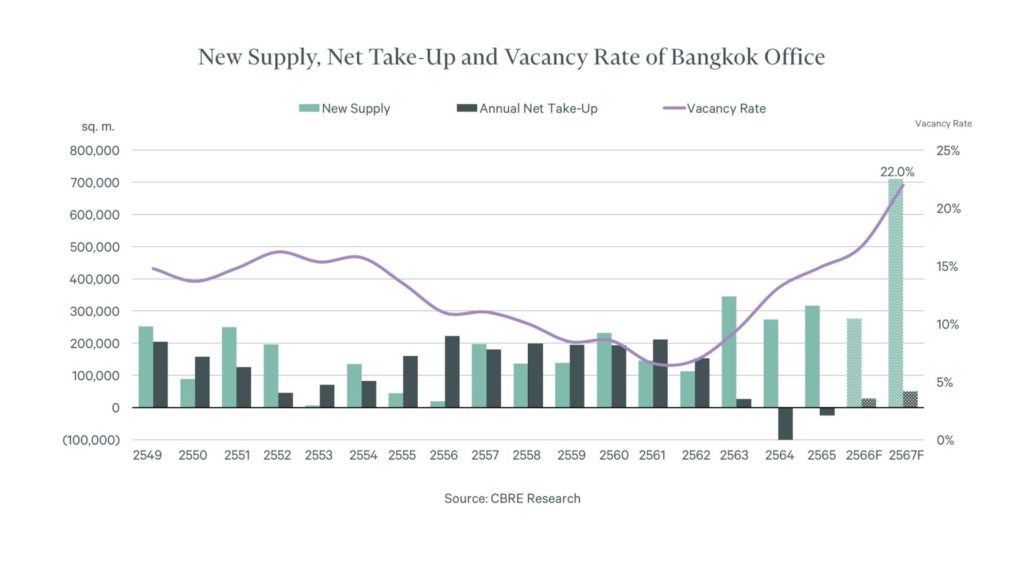

In 2023, the Bangkok office market was much more active, both in terms of new lettings and existing companies relocating to new office premises. The completion of One City Centre and Park Silom marked the first wave of a significant increase in the quality of office space. Over the next two years, more than 850,000 square meters will be completed. While this will give tenants a significant advantage in seeking favorable rental terms, these new international-standard buildings will bring new impetus to an aging office stock where over 60% of existing buildings are more than 25 years old. The year ended with a significant increase in leasing inquiries, which should carry through to 2024.

New Supply, Net Take-Up and Vacancy Rate of Bangkok Office

Source: CBRE Research

“We expect 2024 to continue the momentum built up in 2023, with more companies actively considering moving to newer office buildings in established areas within Bangkok. Existing buildings that are well-maintained and renovated to a high standard will manage to retain some companies, particularly those preferring not to adopt hybrid working. At the same time, others will opt to relocate at a time when they should be able to capitalize on some very attractive lease terms from landlords looking to increase occupancy rates,” added Mr. Sarut Virakul, Director of Office, Advisory & Transaction Services.

Charnwit Pasuwat, Head of Workplace Strategy also noted “We work with both Thai and MNC groups to discuss their real estate footprint needs, as many of these companies have started to incorporate workplace studies to assess how best to address their changing office requirements. In some cases, a refit of their existing office space is sufficient, in others a relocation to more suitable space is the optimal solution.”

Key trends:

- Significant increase in proportion of sustainable and smart buildings

- Multinational and more Thai companies adopting ESG and sustainable office requirements

- Rental rates expected to decline further as competition intensifies

- Landlords actively considering ways to attract and retain tenants

Retail

The retail industry has built on the momentum of customers returning to brick-and-mortar stores, many of which have completed renovations, in addition to new openings. The boost in international tourist numbers has also been particularly beneficial for established enclosed malls in downtown Bangkok. With more retail offerings expected to open in 2024 as part of mixed-use developments, customers will have numerous venue choices for spending their hard-earned disposable income.

Ms. Jariya Thumtrongkitkul, Head of Retail, commented, “Developers and retailers will try to capitalize on rising consumer confidence and increased tourism by focusing on providing exceptional lifestyle, wellness and entertainment experiences to attract customers to their stores.”

Key trends:

- Retail expansion to focus on F&B and wellness

- Large-scale development in provinces but midscale projects in Bangkok

- Retail operators focus on attractions and events to draw footfall

Industrial and Logistics

The industrial sector has enjoyed another busy year, particularly with SILP sales. Ironically, sales could have been further boosted if developers had more land available for sale. The time lag for developers to clear environmental approvals and complete infrastructure investment for additional phases of existing or new industrial estates has been the biggest obstacle holding back sales. This will be a critical area of focus for developers as they look to meet the demands of manufacturers, keen to benefit from BOI policies as they look to diversify operations beyond China.

“Industrial developers are well placed to build on the success of 2023 to attract additional FDI, particularly in the EEC, as long as they can release additional land for their existing industrial estates or bring new estates on stream, as well as constructing ready-built factories to support growing demand from second- and third-tier suppliers,” said Mr. Adam Bell, Head of Industrial & Logistics.

Key trends:

- Demand for space from EV, tech and second-tier suppliers to continue

- Developers focus on developing more land within industrial estates to meet demand

- More competition in the logistics market as new developers enter the market

Hospitality

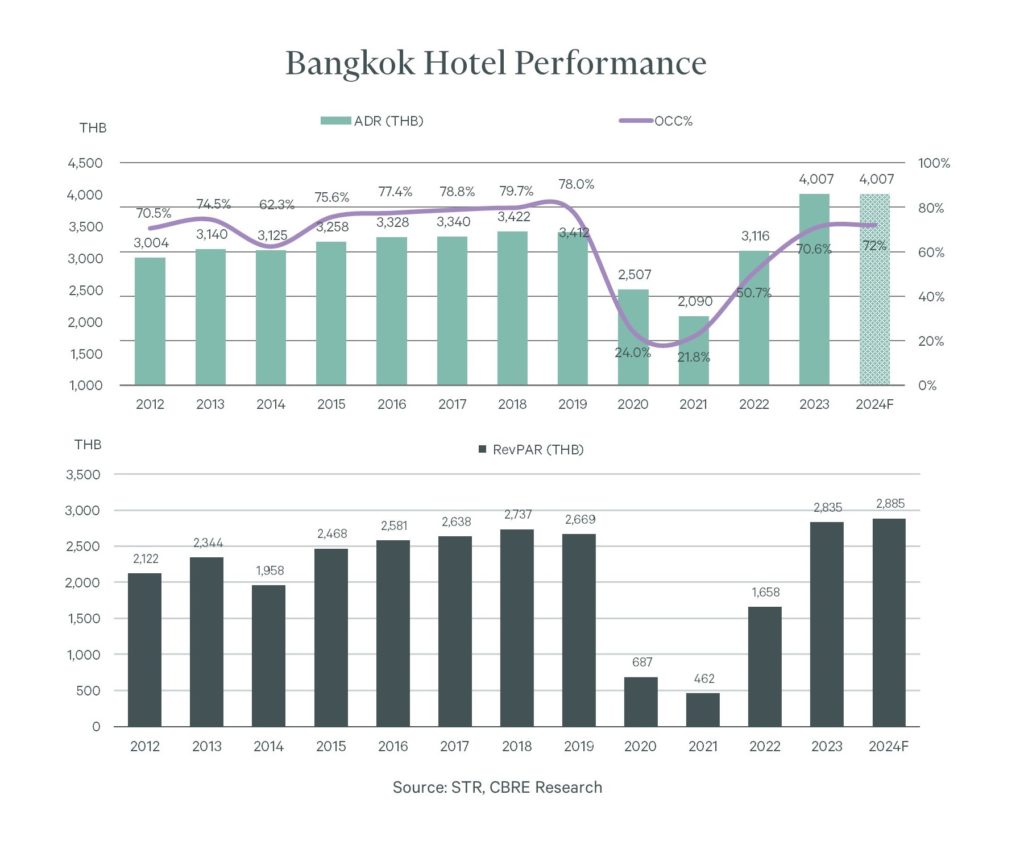

The hospitality sector ended 2022 with considerable optimism, and 2023 proved to be a robust year with tourism numbers increasing more than 150% year-on-year. While tourism numbers have some way to go before matching 2019 levels, Bangkok hotel performance in 2023 reached new highs in terms of other key performance indicators. Average daily rates were 17% above the previous highs of 2018, which, in turn, boosted revenue per available room to a new record high. The prospects for the hospitality sector in 2024 remain positive, although new hotel openings will ensure the market remains competitive.

Bangkok Hotel Performance

Source: STR, CBRE Research

Mr. Atakawee Choosang, Head of CBRE Hotels, added, “The government is working hard to implement policies to attract more international tourists, which should bode well for all segments of the hospitality market in 2024. Despite the expected competition, we believe 2024 will be another positive year for the Thai hospitality sector.”

Key trends:

- Thai government to continue to introduce tourist-friendly policies, aiming to attract 35 million visitors

- Expect another strong year for upscale and luxury hotels and some improvement for midscale segment

- Domestic market is critical, particularly for second-tier locations

Capital Markets

Bangkok continues to draw attention from overseas investors as several local developers have ambitious large-scale mixed-use development plans. Additional investment from overseas remains attractive, particularly with high local funding costs and strict bank lending criteria.

Mr. Barnaby Swainson, Head of Investment and Land, added, “As the tax burden of holding vacant land increases, many landowners are inclined to work with experienced developers to release value through development or long-term leases, so we expect to see more transactions and joint ventures in 2024.”

Key trends:

- Expect more joint ventures with overseas investors to support large-scale development projects

- More land and building transactions if bank lending rates start to fall

- More activity in the land sale market as developer appetite returns